Building Cash Reserves: The Growth Strategy Most Leaders Ignore

Apr 06, 2025

There’s a paradox that even experienced leaders fall victim to: the faster you grow, the more cash you need—and often, the less you have.

While capital efficiency and burn rate are common boardroom topics, few organizations implement a disciplined approach to building cash reserves. The result? Missed growth opportunities, organizational instability, and in some cases, preventable failure.

According to a study by U.S. Bank, 82% of small businesses fail due to cash flow issues—not because of poor products or weak demand, but because they lacked sufficient cash reserves to bridge the gap between growth and liquidity. Meanwhile, nearly 60% of large-enterprise CFOs report delaying strategic investments due to insufficient liquidity, as noted in Deloitte’s CFO Signals™ report (Q3 2023).

Cash reserves aren’t a luxury. They’re a growth engine!

The Cash Crunch That Comes with Scaling

Scaling introduces a cash paradox: while revenues may trend upward, operating expenses surge ahead in anticipation. Leaders increase headcount, invest in new systems, expand into new markets—and do so before cash inflows catch up.

The symptoms are familiar:

- Payroll strains despite strong bookings

- Missed acquisition opportunities due to lack of liquidity

- Short-term borrowing to cover long-term commitments

- Strategic paralysis at the moment when bold moves are most needed

Yet many leadership teams continue to approach cash management reactively. The assumption is that growth will “take care of itself,” or that capital can be raised on-demand. In today’s market—characterized by tighter capital, higher interest rates, and greater investor scrutiny—those assumptions are dangerous.

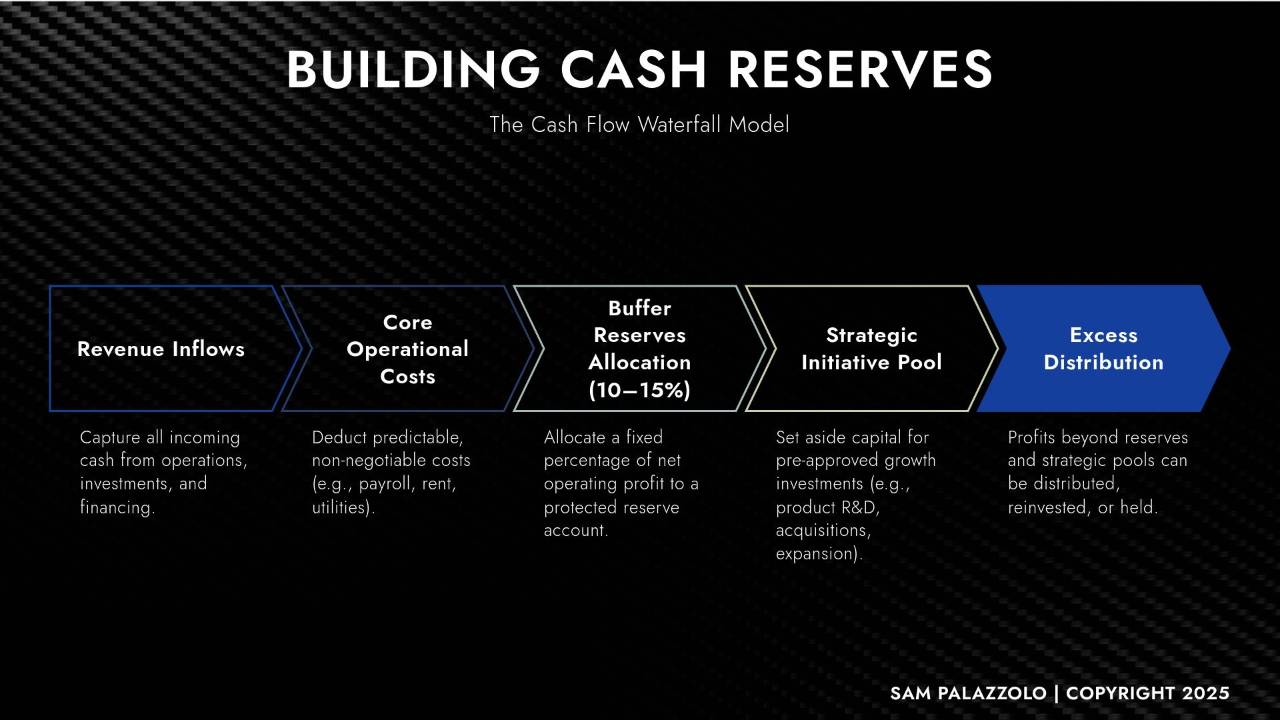

The Solution: The Cash Flow Waterfall Model

To counter the liquidity trap that scaling creates, leaders need a strategic framework—not just a budget. One such framework, derived from liquidity planning approaches advocated by Harvard Business Review, is the Cash Flow Waterfall Model.

This model prioritizes structured cash allocation and reserve building over ad hoc reinvestment or distributions.

The Five-Tier Waterfall:

- Revenue Inflows

Capture all sources of cash—including operations, financing, and investments. - Core Operating Costs

Deduct non-negotiable expenses (e.g., payroll, facilities, subscriptions) to understand baseline burn. - Reserve Allocation (10–15%)

Set aside a fixed percentage of net operating profit into a protected account, earmarked only for business continuity or strategic pounces. - Strategic Growth Pool

After reserves are secured, allocate funds for R&D, product development, geographic expansion, or M&A activity. - Distributions/Reinvestment

Only once the first four layers are covered should funds be distributed to stakeholders or reinvested back into non-core initiatives.

This structure turns cash into a proactive lever—rather than a reactive concern.

Harvard Business Review recommends that companies maintain 6–12 months of operating reserves, particularly during periods of economic uncertainty or aggressive expansion.

Kaplan, S. N., & Strömberg, P. (2009). Should You Be Raising Capital in a Crisis? HBR.

https://hbr.org/2009/03/should-you-be-raising-capital-in-a-crisis

Real-World Application: Scaling with Control

One executive team I advised recently found themselves riding high after winning a major enterprise contract. With a sizable revenue stream secured, they planned a 12-month growth initiative that included doubling headcount, rolling out a new software suite, and opening a second HQ.

But when we ran their numbers through the Cash Flow Waterfall, we uncovered a significant gap. After covering core costs, there wasn’t enough liquidity left to fund all initiatives and build reserves. Their plan put them one surprise expense away from a crisis.

We adjusted course:

- Spread hiring over three quarters instead of one

- Segmented cash into a protected six-month reserve

- Prioritized strategic growth tied to direct revenue outcomes

Twelve months later, they didn’t just scale—they did so with control. The enterprise client expanded their contract, and the company is now using its reserves to fund a bolt-on acquisition.

Why Leaders Must Prioritize Liquidity in 2025

In the rush to chase top-line growth, cash reserve strategies are often overlooked. But in uncertain environments, liquidity becomes the ultimate competitive advantage. It allows you to:

- Stay operational during unexpected disruptions

- Capitalize on underpriced assets or distressed competitors

- Retain talent during market downturns

- Negotiate from a position of strength with partners and lenders

More importantly, it grants peace of mind—and that, for most leaders, is invaluable.

Final Thoughts: Don’t Wait to Build Your Reserve Strategy

Building cash reserves isn’t a sign of caution. It’s a signal of readiness.

When you operate from a position of strength—cash in hand, strategy in place—you can scale deliberately, respond rapidly, and lead decisively.

If your business is growing, but your cash strategy hasn’t evolved with it, you’re not alone. But it’s time to make the shift from reactive liquidity management to proactive reserve planning.

– Sam Palazzolo, Principal Officer @ The Javelin Institute

Real Strategies. Real Results.

P.S. Join the newsletter at https://sampalazzolo.com to receive updates, tools, and exclusive invitations to both.

KEY TAKEAWAYS

- 82% of businesses fail due to cash flow problems – the #1 silent killer of growth.

- 60% of large-company CFOs delay investments due to liquidity constraints.

- The Cash Flow Waterfall Model offers a five-tiered approach: Revenue Inflows → Operating Costs → Reserves → Strategic Pool → Distributions.

- HBR recommends 6–12 months of operating reserves as standard.

- Real-world application shows that building reserves can protect scaling efforts and create room for strategic action (e.g., acquisitions).

- Leaders should stop viewing cash reserves as conservative and start viewing them as strategic growth levers.

SUBSCRIBE FOR WEEKLY BUSINESS SCALING STRATEGIES

REAL STRATEGIES. REAL SOLUTIONS.

We respect your privacy. Unsubscribe at any time.